Sports lovers across the world share a common passion for speculation match outcomes and anticipating the performance of their favourite teams and players. The advent of fantasy sports apps like ESPN Fantasy, DraftKings, FanDuel, RealFevr, etc., has elevated this excitement by offering a rewarding opportunity to earn money based on accurate projections. This trend has gained significant momentum globally, including in India, where domestic fantasy sports platforms like Vision11, Dream11, My11 Circle, etc., are making waves, particularly in the world of cricket.

What is a Fantasy Sports App?

Fantasy sports app developers create digital platforms that enable users to build imaginary teams consisting of popular sports personalities. These teams earn points or rewards based on the real-match performance of each player and team. These apps cover a wide range of sports, from soccer and golf to cricket and hockey, providing fans with an immersive and rewarding experience.

Current Landscape of Indian Fantasy Sports Apps

The popularity of fantasy sports apps is not limited to the USA and the UK; it is also gaining traction in Asian countries like India. Homegrown platforms such as Vision11, Dream11, My11 Circle , etc., are enabling fans to actively participate in the excitement of cricket and other popular sports. The India Fantasy Sports Market has seen remarkable growth, with a valuation of USD 25.44 billion in 2022, expected to reach USD 72.06 billion by 2030, showcasing a CAGR of 13.9% from 2023 to 2030.

In 2023, cricket dominated the fantasy sports landscape in India, with an 85% share of registered users, followed by kabaddi at 26%. The impact of the coronavirus pandemic also led to increased interest in alternative sports like baseball among Indian fantasy sports providers and users.

Major players in the Indian fantasy sports market, including Dream11, MyTeam11, MPL, and HalaPlay, have attracted significant investments and partnerships. In 2020, Dream11 secured a $225 million investment, bringing its valuation to $2.5 billion. The industry has also witnessed strategic mergers, such as DraftKings and SBTech, FanDuel and Betfair US, and The Stars Group and Sky Betting and Gaming, demonstrating consolidation and expansion strategies.

Profitability Factors of Fantasy Sports Apps

The profitability of Indian fantasy sports apps is driven by several factors. The increasing number of annual sports events and leagues, such as the IPL T20, Vivo Pro Kabaddi League, and ICC Cricket World Cup, contributes to the growing popularity. Additionally, the rise of media channels, including YouTube channels, vlogs, TV shows, blogs, and forums, where experts analyze upcoming trends related to fantasy sports, plays a significant role.

The market research conducted by Custom Market Insight Market Research Team projects a CAGR of 13.9% from 2023 to 2030, with the market size reaching USD 28.98 billion in 2023 and an anticipated valuation of USD 72.06 billion by 2030. This growth is attributed to the online gaming industry’s increasing popularity, fueled by high-speed internet and smartphone accessibility.

Challenges and Risks:

While the prospects seem promising, the fantasy sports app industry is not without challenges. Legal and regulatory challenges pose a risk, with the need for adherence to evolving regulations. Competition within the market is fierce, with platforms vying for user attention and loyalty.

Legal and Regulatory Challenges:

As the fantasy sports app landscape evolves, legal and regulatory challenges may emerge. Adhering to guidelines and staying compliant with changing regulations is crucial for sustained success.

Competition within the Market:

The industry giants like Dream11, MyTeam11, MPL, and HalaPlay face intense competition. Innovation, user experience, and marketing and advertising strategies become paramount in retaining and attracting users.

Conclusion

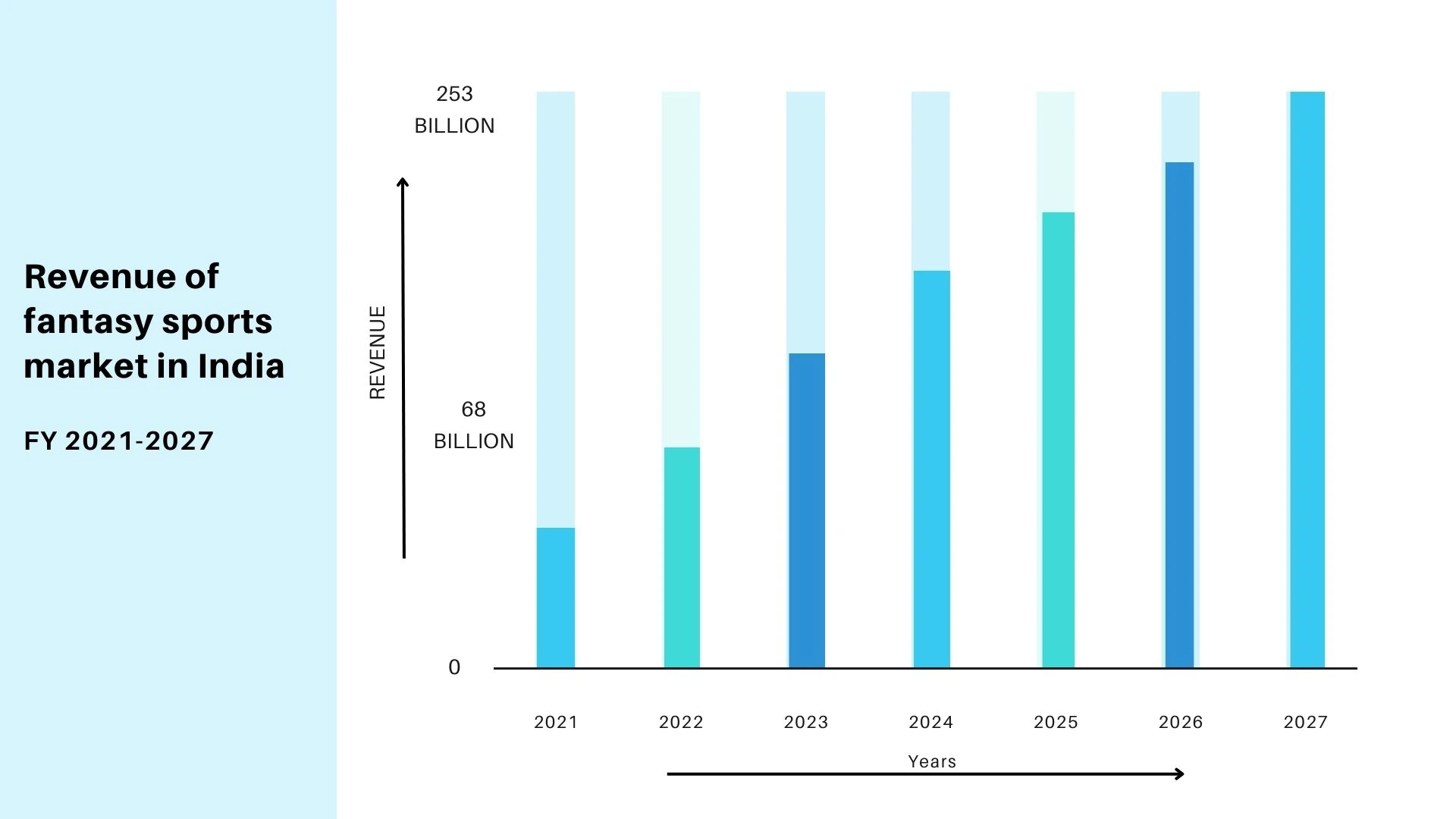

The financial year 2022 reported a revenue of 68 billion Indian rupees in the Indian fantasy sports market, with forecasts indicating continued growth, reaching 253 billion Indian rupees by fiscal year 2027. The amalgamation of passion, technology, and strategic partnerships has propelled the profitability of Indian fantasy sports apps, making them a lucrative avenue for sports enthusiasts looking to turn their speculation into tangible rewards. As the market continues to evolve, the future looks promising for both fans and stakeholders in the dynamic realm of fantasy sports, solidifying their profitability in FY 2024.