Proudly Serving 25+ Brands

Proudly Serving 25+ BrandsBuilding Scalable Digital, Marketing & Sports Solutions for Global Businesses

Togwe is a global AI-powered services company delivering gaming platform development, performance marketing, digital growth, operations, and sports-focused solutions.

We help businesses launch, scale, and optimize high-performance platforms with measurable results.

Get a Free Consultation

AI-driven solutions powering gaming,sports,and digital growth at scale.

We build AI-powered systems that drive real performance across gaming, sports, and digital platforms. From smarter engagement to scalable growth, our solutions are engineered for speed, accuracy, and impact.

Explore our Services

Sports App Development

Secure, scalable platforms built for performance and growth.

Digital Marketing

Intelligent user acquisition, optimization, and revenue growth.

Content Creation

Data-informed content that drives engagement and brand recall.

Customer Support

AI-assisted support workflows for faster resolution and retention.

Branding & Advertising

Insight-led branding and measurable advertising outcomes.

Sports Sponsorship Management

Data-backed sponsorships and long-term partnerships.

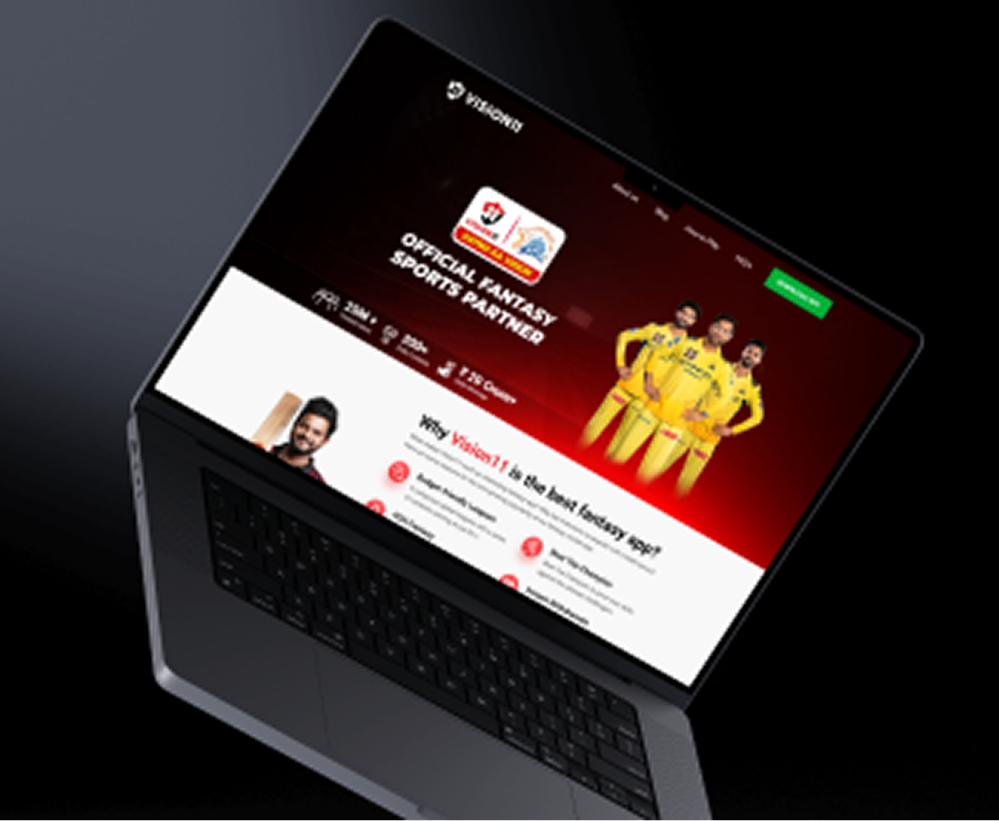

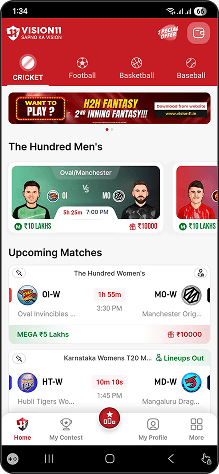

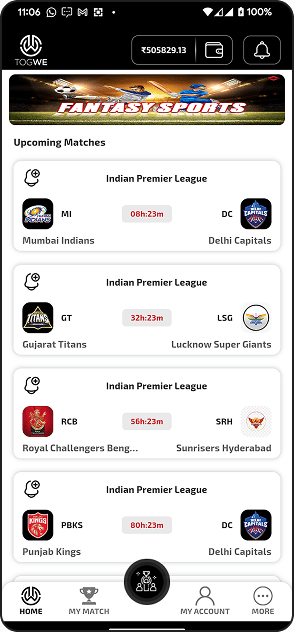

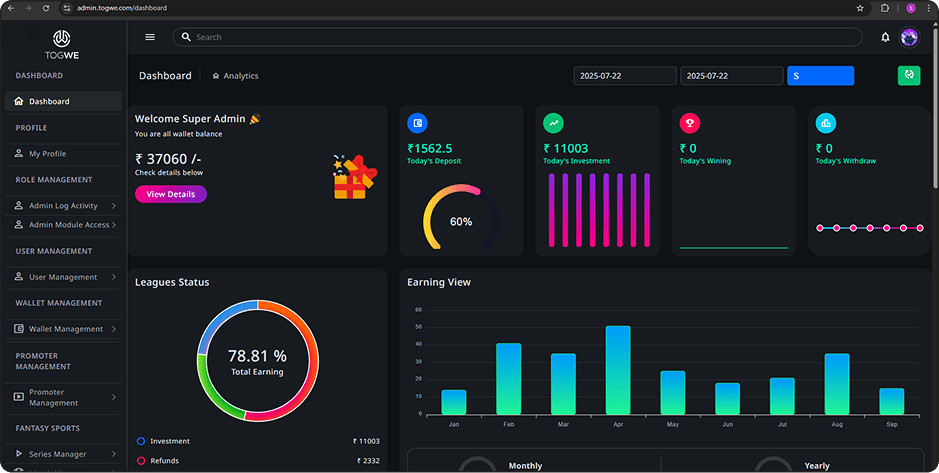

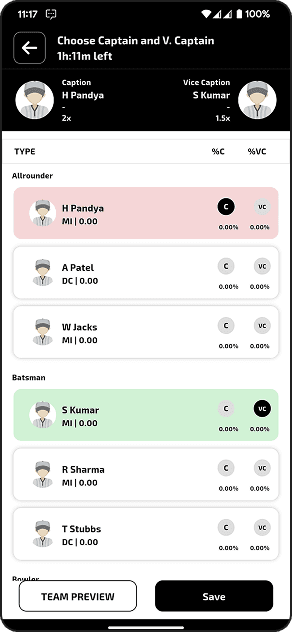

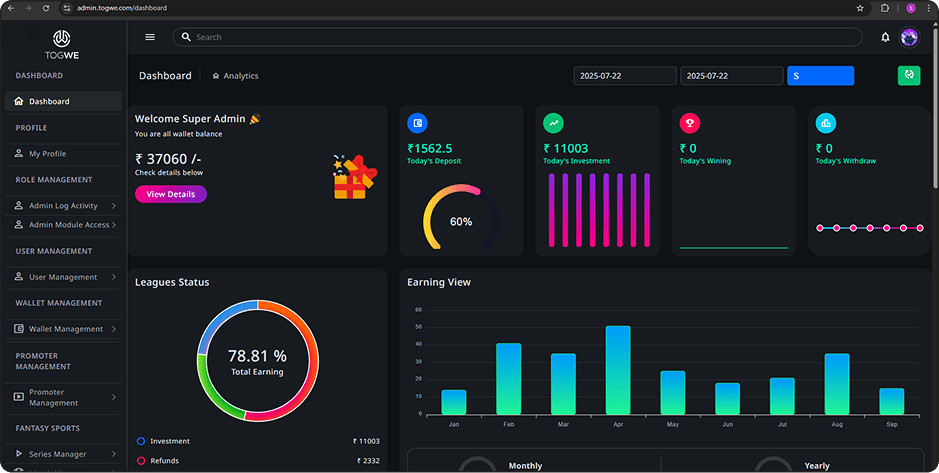

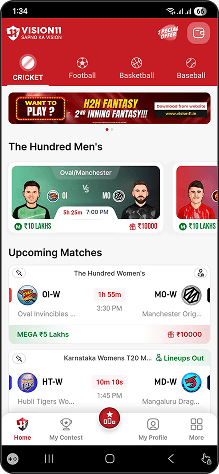

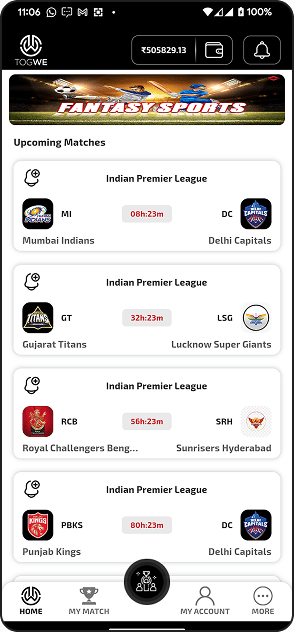

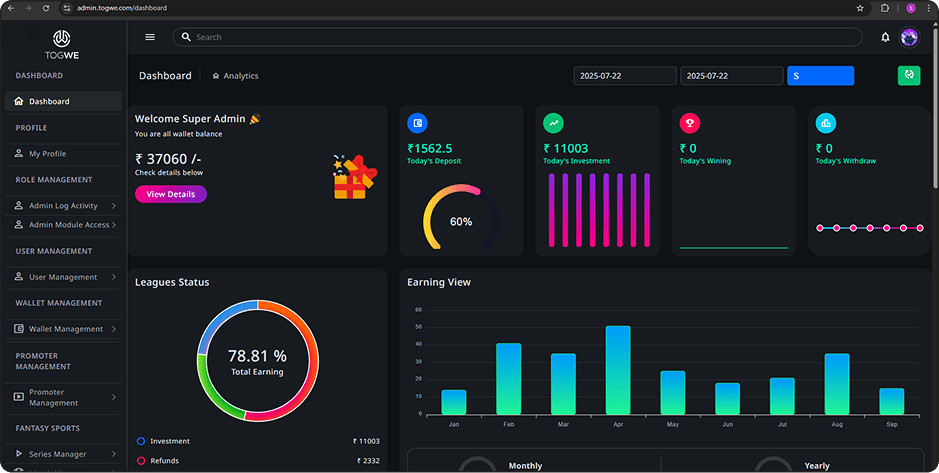

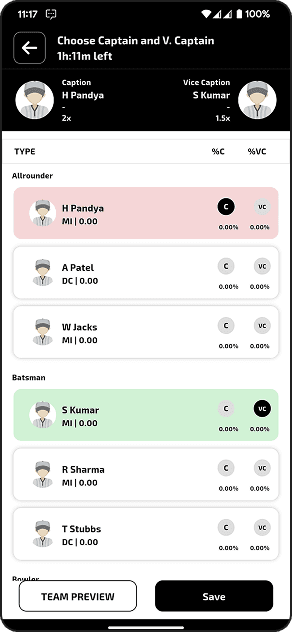

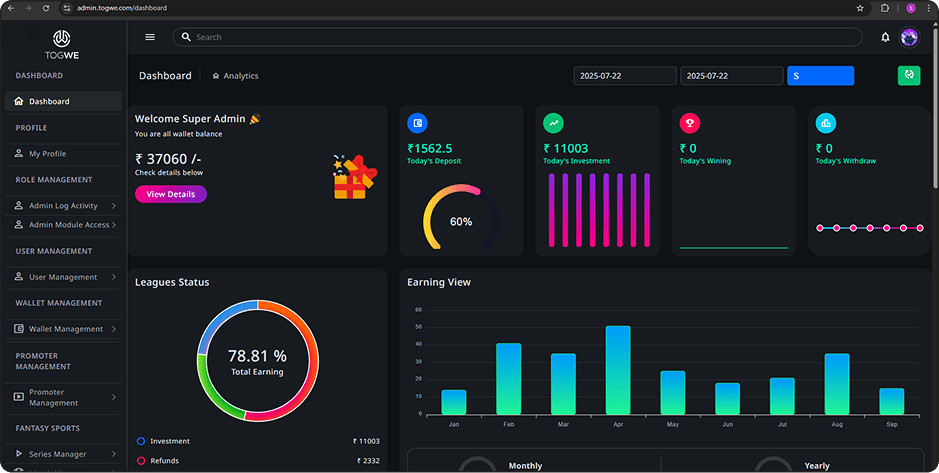

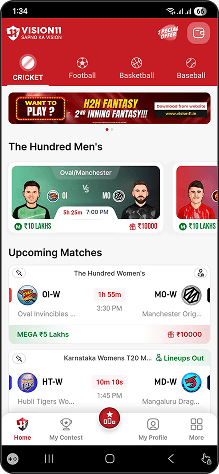

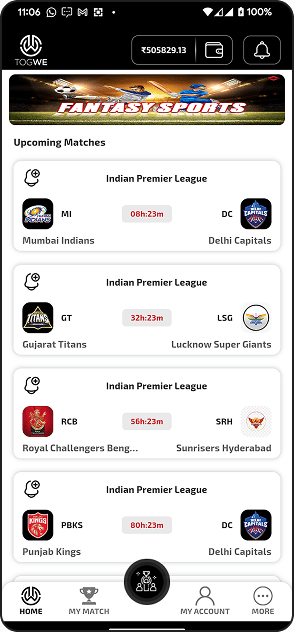

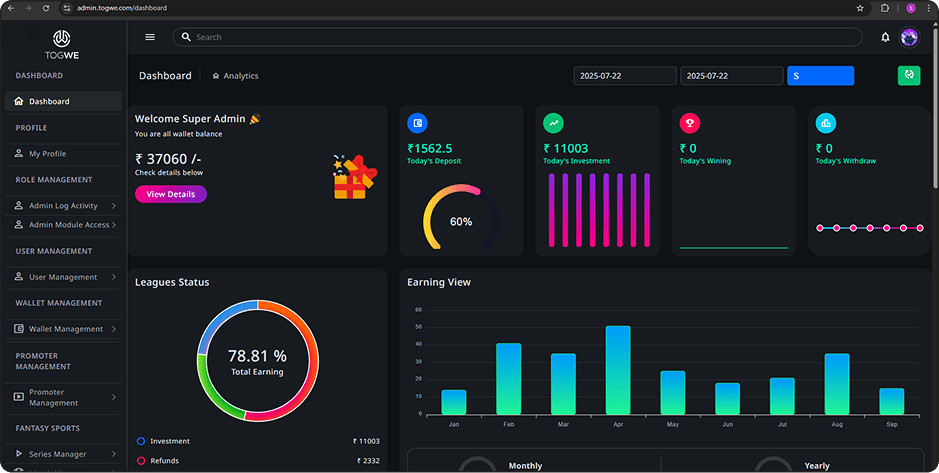

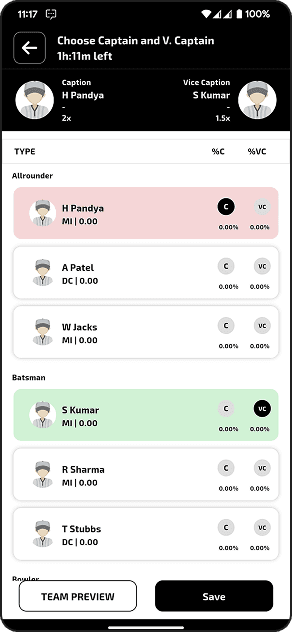

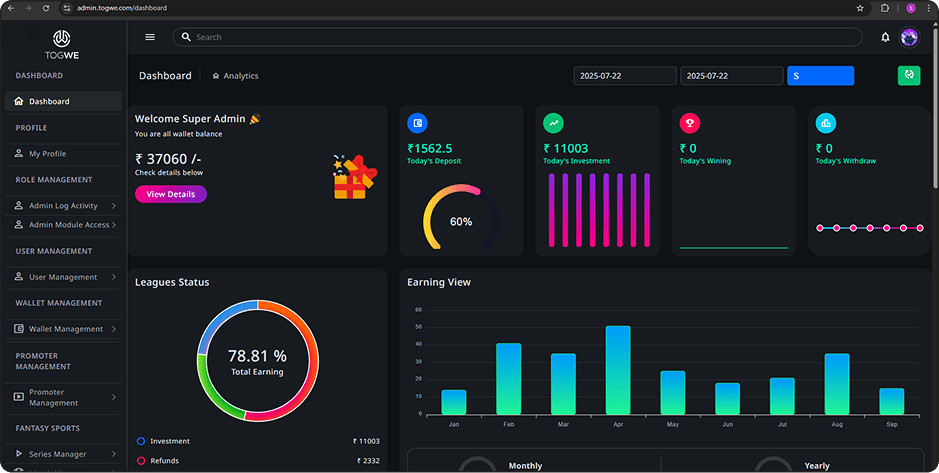

Glimpse of Mobile & Web Apps

A Glimpse of Your Next

Sport Platforms in Action

Take a tour through our sports app’s interface and see how every screen is thoughtfully designed for performance, clarity, and user satisfaction.

Who we are?

Togwe is a global services company operating at the intersection of gaming, technology, marketing, operations, and sports. We partner with platforms, organizations, and enterprises to deliver practical, scalable, and performance-focused solutions that support long-term growth.

We don’t offer generic services — we build systems, execution models, and partnerships that scale.

Our Values

Transparency

Clear communication, honest execution, and measurable outcomes

Performance

Every solution is designed to drive efficiency, growth, or engagement

Accountability

Ownership of execution, delivery, and results

Long-Term Growth

We focus on sustainable partnerships, not short-term wins

Growth

0%

Established

0

Successful Projects

0+

Users Impacted

0M+

Who We Work With

We partner with organizations that value performance, scalability, and long-term growth.

- Established businesses and enterprise teams

- High-growth companies scaling globally

- Sports organizations and ecosystem partners

- Digital-first brands with complex operations

- Innovation-led companies seeking measurable results

Our clients

Agile. Transparent. Built to Scale.

We follow an Agile-driven development and growth model designed for gaming platforms, where speed, performance, and continuous improvement are critical.

1. Discovery &

Strategy

2. Product &

Experience Design

3. Agile Development

(Sprint-Based)

4. Testing, Security &

Performance

5. Launch & Growth

Enablement

6. Scale, Optimize &

Evolve

Our Case Study

We aren’t just all talk company—rather we are go and build it experts. Take a look at our portfolio of successful projects.

Togwe has been recognized for delivering top-quality IT solutions and marketing services to businesses across the globe.

Take a look at what our past clients say about our mobile app development and other services.

Frequently Asked Questions

Insights That Power Growth

Explore articles on gaming platforms, AI-powered technology, digital natives, and performance marketing - designed to help you get ahead in the fast-paced digital design world.

Do You Know How Much Hardik Pandya Gets Paid for One Insta Post? (2026)

Hardik Pandya has established himself as one of the most followed cricketers in India on Instagram. The figures below reflect a public figure who has expanded beyond the cricket field into the world of lifestyle, fashion and bold personal expression that a younger generation of fans find attractive and appealing. Several influential analytical […]

Do You Know How Much Shikhar Dhawan Gets Paid for One Insta Post? (2026)

Shikhar Dhawan is one of the most engaging and entertaining personalities in Indian cricket. He has amassed a following of nearly 20 million people on Instagram, which is always more than the runs he scores at the top. He brings joy to the game. He has taken that same quality to his social […]

Do You Know How Much Sachin Tendulkar Gets Paid for One Insta Post? (2026)

Sachin Tendulkar hasn’t played a competitive match in over a decade and it doesn’t matter. The people who love cricket in India and around the world haven’t moved on and aren’t going to move on. He may have retired from the game, but the game hasn’t taken him out of people’s minds, and […]